This is a level 3 number activity from the Figure It Out series. It relates to Stage 6 of the Number Framework.

A PDF of the student activity is included.

Click on the image to enlarge it. Click again to close. Download PDF (4301 KB)

Number Framework Links

These pages involve adding and subtracting 2- and 3-digit whole numbers, dividing an amount by 9, and recording financial information in a table.

Students working at stage 6 should be able to do the mathematical calculations mentally. Those at stage 5 should also be able to do them but may need the support of materials such as tens money.

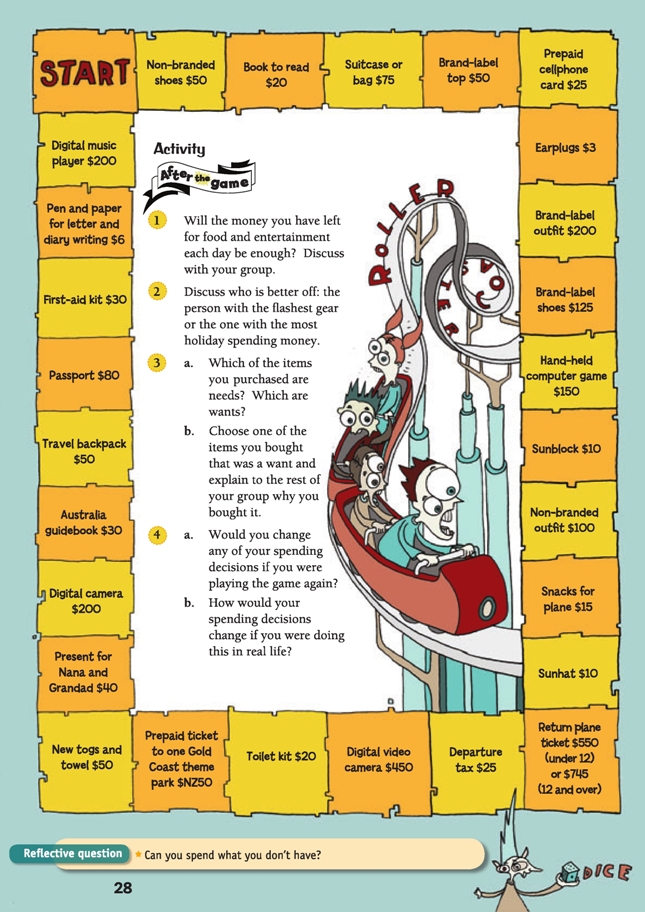

2-4 players, a counter each

A dice

A stopwatch or timer

FIO, Level 3, Financial Literacy: Saving for a Holiday, Spending Splurge, pages 27-28

Copy of the purchases recording sheet each (see Copymaster)

Game

Financial understanding

This game reinforces for the students that people’s financial decisions differ because they all have different preferences. “Needs” ought to be budgeted and paid for first. “Wants” vary between people; in this game, they should be purchased last during the students’ “spending splurge”.

The students will be identifying and managing financial resources during the game in order to buy the essential items they need and to spend their funds on items they want.

In this simulation game, students have to buy items for a holiday, making sure that they buy all the essentials, such as plane tickets and passport, as well as budgeting enough for holiday spending money.

Introduce the game by revisiting the definitions of needs (essentials, things that would stop you going on holiday if you didn’t have them) and wants (desirables, things that are optional but that you would like to have or do if you could). These ideas were touched on in Holiday Plans and Budgets, pages 4–6 of the students’ book.

Before they look at the list of essentials on page 27, ask the students to make a list of the things they think would be defined as needs if they were going on holiday to Australia. The distinction between needs and wants is a difficult one for many students to grasp and can bring up some interesting reasoning during discussion.

Some may feel that it is essential that they look trendy, so items that help them to do this are classified as needs! Help them to clarify the difference according to the financial definitions of wants and needs by using the question “Would you still be able to go on holiday if you didn’t have that?” Help the students to recognise that

individuals will differ in their reasons for desiring to purchase a “want”. They will vary in the degree to which that want is important to them and how much they’re willing to trade off to buy it, but “wanting” it desperately doesn’t make it become a “need”!

Check that students are able to use the recording sheet by discussing the terms at the tops of the columns (Item purchased, Debit [withdrawal], Balance). Ask What calculation is needed to work out the next line of the balance column each time? (subtraction of the cost of the item from the previous balance)

Activity

Financial understanding

The discussion in the after-game activity should encourage the students to accept that by making priorities for their spending, they will be “better off” (financially and socially) and more likely to be happy with their purchases. The financial decisions that people make determine how “well off” they are now and in the future.

The students may realise that someone who purchases lots of “wants” may be very happy with the items now but not so happy about the consequences later, for example, no money left for food and entertainment. There is a consequence for each financial decision that a person makes; good financial decisions bring benefits.

The students are communicating and receiving ideas and information when they discuss and justify the decisions they made with their classmates.

Social Sciences Links

Achievement objective:

• Understand how people make decisions about access to and use of resources (Social Studies, level 3)

The students could work through the Spending Splurge scenario in relation to their own classroom. What are the needs and wants of the classroom? How are these decided? How are these funded? Who makes the decisions? How are the students in the class affected?

Discussion finale

Financial understanding

If you have been using this book as a unit, you may like to have a discussion to reflect back over the whole theme. Get the students to flick back through the students’ book to remind them of the different activities. They could answer some of the following questions in small groups and then report back to the whole class.

Which activities did you find most interesting?

What are some financial words that you have learned to use?

Did you find anything out during this unit that surprised you or changed your ideas about something?

Look back through the key financial ideas in the book. Choose three that you think are important for you to remember.

Why did you choose those ones?

How could you use what you have learned by doing these activities in your own financial dealings?

Do you have any questions about financial matters that weren’t answered while you were doing this unit?

Students could create a poster or a computer slideshow to summarise and explain some of the key financial ideas that they learned.

Social Sciences Links

Achievement objective:

• Understand how people make decisions about access to and use of resources (Social Studies, level 3)

The students could discuss or write about these questions:

– What have you learned about resources, needs, and wants?

– Who makes these decisions in your life?

– How do you or they make these decisions?

– How are decisions about school or student resources, needs, or wants made at your school?

Other Cross-curricular Links

English achievement objective:

• Ideas: Select, form, and communicate ideas on a range of topics (Speaking, Writing, and Presenting, level 3)

Students could write letters, emails, or postcards, in role as one of the Murphys on holiday, to their friends back home or afterwards as a thank you letter or email to their grandparents. Get them to include what the Murphys might have learned from the experience of saving for a holiday.

Answers to Activity

Game

A game focusing on needs and wants

Activity

1. Answers will vary, depending on the game.

2. Opinions will vary.

3. a. Needs should include passport, tickets, departure tax. Note: Although travel

insurance is not included in this game, it is usually considered a “need” for overseas

travel. Wants include items like brand-label shoes and snacks. You could argue either way for some items, for example, new shoes could be a need if you don’t have any that are suitable to take or a want if you already own several pairs that would be fine.

b. Choices and reasons will vary.

4. a.–b. Answers will vary.

Reflective question

You can, for example, if you use a credit card, but you have to pay it back with interest. And if you don’t have the spare money to cover that interest, there are other consequences to take into account, such as getting further into debt or not having the

money for basic requirements, such as food.