This is a level 4 number and algebra activity from the Figure It Out series. It relates to Stage 7 of the Number Framework.

A PDF of the student activity is included.

Click on the image to enlarge it. Click again to close. Download PDF (2065 KB)

use rates to calculate exhange rates

find a percentage of a number

use multiplicative strategies to solve money problems

Number Framework Links

Students undertaking this activity need to be at stage 7 or above. They will be required to solve rate problems involving decimal multipliers, so they will be working towards advanced proportional thinking (stage 8).

Rate problems involve a multiplicative relationship between two measurements. In the case of exchange rates, the measurements are the values of two different currencies. When we say the exchange rate for converting New Zealand dollars into Australian dollars is 0.92, we mean that NZ$1.00 is exchanged for A$0.92 (92 Australian cents).

Calculator

Activity One

Financial language

Tax, suppliers, import, freight, Customs, exchange rate

Financial understanding

Whana’s keenness to “shop around” for the best prices for his materials demonstrates good business decision making. He also sees the benefits of using overseas suppliers for buyers of large-scale production, that is, lower production costs. In his investigations, he collects, organises, and analyses a range of financial information. Whana also learns that it is necessary to be compliant with the law.

Mathematics and statistics

To attempt these pages, the students need to have worked through the previous four pages of Whana’s story (pages 9–12) because answers from these pages are used to make further calculations. The students may not be aware of the term “middleman” that is used on these pages. A middleman is a person who brokers a deal between two parties or on-sells items he/she has bought to someone else without doing

anything to the items. A middleman adds to the cost of items by taking a cut for arranging the sale and purchase. In Whana’s case, he would pay a middleman if he bought overseas-made T-shirts from someone in New Zealand.

Many students will have experience with exchange rates through travelling abroad. Use currencies that they are familiar with to introduce the idea. For example, Australia’s dollar is usually worth more than New Zealand’s dollar. That means it costs more than NZ$1.00 to buy A$1.00 and less than A$1.00 to buy NZ$1.00. (This means that NZ$1.00 will buy less than A$1.00.) Exchange rates are given as decimal amounts, accepting that the decimal places are not always obvious. For example, the rate a bank sells Australian dollars to a customer in exchange for New Zealand dollars might be 0.8751, meaning that the customer receives 87.51 Australian cents for each New Zealand dollar (or 0.8751 Australian dollars). Built

into these rates is a bank fee that masks the relationship between these two rates.

To simplify matters, suppose it took one-and-a-half New Zealand dollars to buy one Australian dollar and there were no commission charges, and you have Australian dollars to sell. The bank would tell you it will buy A$1.00 for NZ$1.50. This means the bank will give you $NZ1.50 for every A$1.00 you give them. This could be shown as:

The reverse of this is to think of what the New Zealand bank would have as a “sell” rate for Australian dollars, that is, how many Australian dollars could be bought for NZ$1.00. The left-hand dotted line above shows that NZ$1.00 buys only two-thirds of A$1.00 (2/3 is the reciprocal of 3/2 or 1 1/2 ). So the “sell” rate for Australian dollars is 0.67, that is, for NZ$1.00, you will only get 67 Australian cents.

Inverse flow diagrams are another common and helpful way of expressing this somewhat difficult concept. The multiply/divide functions demonstrate the inverse relationship of buying and selling.

The students can use their calculators (1 ÷ 1.5 = 0.6) to check that this calculation is the same as multiplying by two-thirds.

Fluctuations in exchange rates are a significant risk for any business involved in exporting or importing. A higher New Zealand dollar means that exporters suffer because the price they earn overseas is worth fewer New Zealand dollars. Importers prefer a higher New Zealand dollar because it makes the goods they bring

into the country cheaper in New Zealand dollars. A lower dollar has the opposite effect.

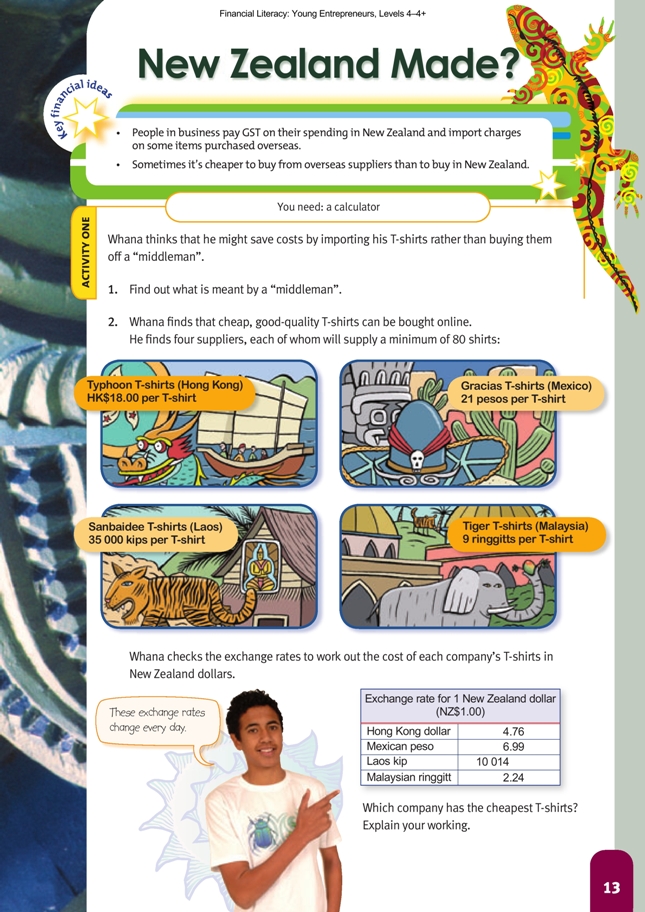

Question 2 requires the students to calculate what a T-shirt from each country will cost in New Zealand dollars. For example, the exchange rate table says the NZ$1.00 buys HK$4.76. The cost of the T-shirt is HK$18.00. The problem can be modelled using a double number line:

Given this model, ask the students what operation they might perform to work out the cost of the T-shirt in New Zealand dollars. Some might suggest finding out how many times 4.76 goes into $18.00. This can be written symbolically as either x 4.76 = 18.00 or 18.00 ÷ 4.76 = . Using a calculator is appropriate for this calculation, although you could encourage the students to estimate the answer first. The completed double number line might look like this:

Given this support, get the students to work out the cost of one T-shirt from each country and complete question 3. Some students may not know that freight is the cost of transporting the T-shirts from the country of origin to New Zealand.

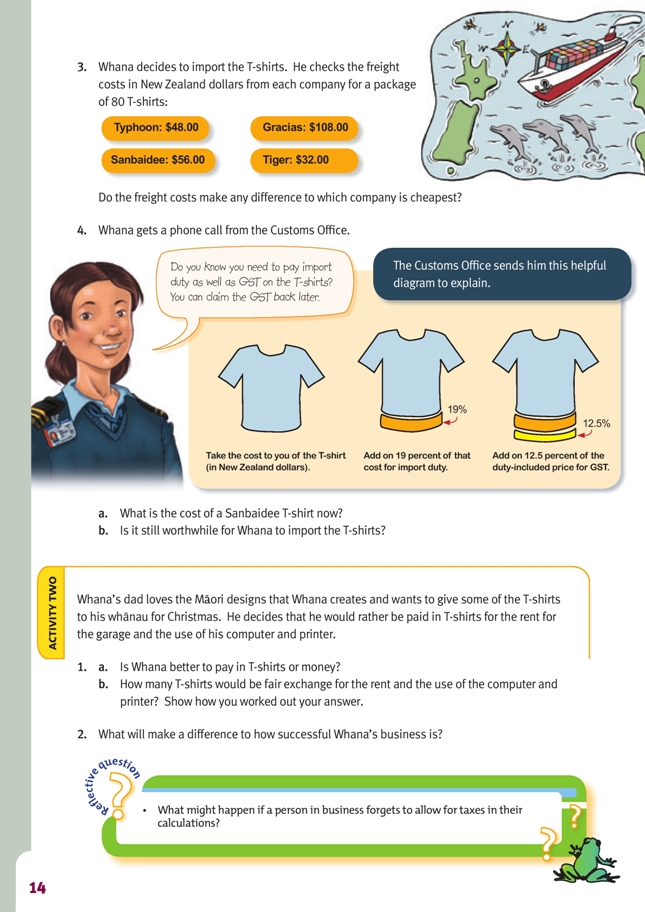

Question 4 involves some difficult calculations with percentages. Strip diagrams or double number lines may be needed to support some students. The cost of one Sanbaidee T-shirt is $4.20 ($336 ÷ 80). The addition of 19 percent duty looks like this diagrammatically:

Ask the students what tidy percentage is close to 19 percent and what fraction that is. 20 percent means 20/100 (twenty out of one hundred) and has and as equivalent fractions. 10 percent (1/10) of $4.20 is 0.42, so 20 percent (2/10) is 0.84. So the price including duty should be a little less than $4.20 + $0.84 = $5.04.

This can be calculated exactly on a calculator by keying in 4.2 + 19% (= may be needed) or 4.2 x 1.19. So the price including duty is $5.00 (rounded from 4.998). This is the price that goods and services tax (GST) is calculated on.

GST of 12.5 percent may appear a clumsy percentage, but you can illustrate it easily using a Slavonic abacus or a hundreds board.

Diagrammatically, adding 12.5 percent to $5.00 may be represented as:

Encourage the students to estimate/calculate the GST component. This might be done in several ways, for example:

10 percent of $5.00 is 0.50, 5 percent of $5.00 is 0.25, so 2.5 percent of $5.00 is 0.125, so 12.5 percent is 0.50 + 0.125 = 0.625 (62.5 cents).

1/8 of 500 is a bit more than 0.60 because 8 x 0.60 = $4.80.

A calculator can be used to get the exact amount: 4.998 + 12.5% is $5.62 rounded down. If you used the rounded import duty amount ($4.998 rounded to $5) and then did your GST calculation on that amount and rounded it (5.652 to 5.63), the result would be a 1 cent difference. This seems a small amount, but small “errors” such as this can compound very quickly into big ones; 1 cent might not seem very much,

but for larger orders (for a big firm, for example), the end result might be a larger tax bill than necessary. For multi-step problems, encourage your students to analyse each step separately and then do the final calculation in one go, rounding only the last step to minimise error.

Social Sciences Links

Achievement objective:

• Understand how people and consumers exercise their rights and meet their responsibilities (Social Studies, level 4)

Have the students discuss the following:

– In this situation, Whana is a consumer. What rights and responsibilities does he have?

– Whana is looking at buying from overseas. Will his rights as a consumer be different? How might this impact on his decision?

Activity Two

Financial understanding

This activity introduces the idea of barter, in which two or more people exchange goods or services with each other. Barter preceded money historically as the mechanism for settling transactions and is still common today. Internet and newspapers facilitate trading using either money or the goods as a currency.

In this scenario, Whana’s dad is bartering the use of his garage and computer for some of the T-shirts that Whana produces. The advantage for Whana in this arrangement is that it cuts down the amount of money he needs initially to make the T-shirts because he doesn’t need cash to pay his rent and computer costs.

The disadvantage is that the rent still costs him in time and materials. This cost could be easily forgotten.

This also illustrates the limitations of barter in that there has to be a “coincidence” of wants between Whana and his dad. If Dad didn’t want Whana’s T-shirts, Whana would have had to pay for the use of the garage and computer.

Whana would be more financially responsible if he were to calculate the real cost of his rent (about $10 per day) rather than calculating how many T-shirts he can afford to barter for these goods and services. Any decision he makes about giving his father a more favourable deal is then based on sound information to determine the “real cost” rather than making an emotional decision.

Reflective question

Failure to pay taxes is a major reason for the demise of many small businesses. Financially responsible businesses factor the cost of taxation into the prices they charge. The implications of failing to pay taxes are usually only realised long-term, when the business is audited (their accounts checked) by Inland Revenue. Audits sometimes reveal taxation that hasn’t been paid, and unwary business owners can end up with large bills that were unexpected.

Social Sciences Links

Achievement objectives:

• Understand how people make decisions about access to and use of resources (Social Studies, level 3)

Have the students discuss how Whana’s dad might be influencing Whana’s decisions about access to resources, such as the garage.

• Understand how exploration and innovation create opportunities and challenges for people, places, and environments (Social Studies, level 4)

Have the students discuss:

– What opportunities has Whana created through his innovation?

– What challenges has he had?

Answers to Activities

Activity one (page 13)

1. Answers may vary. A middleman is someone who handles a commodity between its producer and its consumer. (In this case, Whana would be the middleman’s consumer. If he buys the T-shirts direct, he is cutting out the middleman and thereby

reducing his costs.)

2. Gracias T-shirts has the cheapest. In each case, to get the New Zealand dollar value, divide the cost of the T-shirt by the exchange rate given: for Typhoon,

HK$18 ÷ 4.76 = $3.78; for Gracias, 21 pesos ÷ 6.99 = $3.00; for Sanbaidee, 35 000 kips ÷ 10 014 = $3.50; for Tiger, 9 ringitts ÷ 2.24 = $4.02.

3. Yes, they do. The Sanbaidee T-shirts from Laos are now the cheapest at $336 ($3.50 x 80 + $56), with the Gracias ones next at $348 ($3 x 80 + $108). The

Typhoon ones would cost $350.40 ($3.78 x 80 + $48) and the Tiger ones would cost $353.60 ($4.02 x 80 + $32).

4. a. $5.62. (NZ$4.20 cost [includes freight] + 19% + 12.5% of that total)

b. Yes. It would cost him $10 to buy a basic T-shirt locally, so he would pay less using imported T-shirts.

Activity Two (page 14)

1. a. Answers will vary. For example, paying in T-shirts improves Whana’s cash flow, but it still takes him time to print the T-shirts.

b. Answers may vary. Over 10 days, the garage rental would be $100 and the cost of using the computer and printer $120. Not paying for these saves Whana

only $2.75 per T-shirt ($220 ÷ 80). At $36.50 per T-shirt if bought in New Zealand, that would mean 6 T-shirts ($220 ÷ $36.50) or, if Whana doesn’t include any profit on the shirts he makes for Dad, 8 T-shirts ($220 ÷ $26.50).

However, if he buys his T-shirts from Laos, he could sell them for about $32 to get a $10 profit. So he could give Dad 7 T-shirts ($220 ÷ $32) or 10 if he gives them to Dad at cost ($220 ÷ $22).

2. Answers will vary. For example, to be successful, Whana will need to sell all his T-shirts, he will need to make sure all his customers pay for the T-shirts (no bad

debts), and his equipment must not break down.

Reflective Question

Answers will vary. For example, if they haven’t put any money aside from the profit they thought they were getting (including what they owed for tax), they may have no money to pay the tax bill when it catches up with them and the business may have to borrow extra money or close down