This is a level 4 number activity from the Figure It Out series. It relates to Stage 7 of the Number Framework.

A PDF of the student activity is included.

Click on the image to enlarge it. Click again to close. Download PDF (764 KB)

use mental strategies to solve multiplication problems involving money

find a percentage of a money amount

Number Framework Links

This activity involves the addition of decimal numbers. It also requires calculation of tax, which involves multiplication and interpretation of decimal numbers. This activity is appropriate for students who are very comfortable working at stage 6 and for those who are at stages 7 and 8. (See the table of NDP material on page 4.)

A calculator

Financial understanding

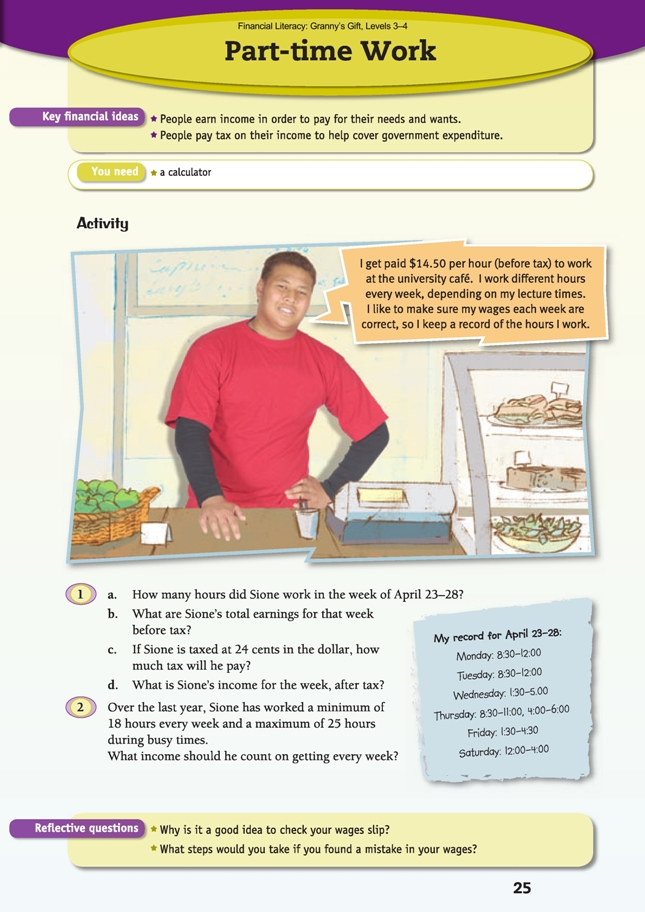

In this activity, Sione uses the extra income he earns to help cover his ongoing costs. However, he must pay part of his earnings to the government as tax (used to cover government expenditure). He keeps accurate records of his work hours and checks these against what he has been paid.

You could relate this activity to the students’ world by looking at the money they might need to earn to buy a popular gaming console. If they have or would like to have part-time work, ask them how they (would) fit this in with school hours, homework, chores at home, sport, dance, swimming practice, rugby practice, and so on.

With regard to question 1c, the students may have questions such as “What is tax?”, “Why do people have to pay tax?”, and “What is tax for?” (Part of Sione’s tax will be subsidising his tertiary education, health care, and his siblings’ schooling, among other things.

Mathematics and statistics

Question 1a is a straightforward question, requiring students to add up the total number of hours Sione works.

Question 1b requires students to multiply 22 (hours worked) by $14.50 (hourly wage). This can be calculated mentally, using a strategy such as ($14.50 x 10 x 2) + ($14.50 x 2) = $290 + $29 = $319.

Extension

Mathematics and statistics

An extension to questions 1c and 1d could be to find out the current tax rates. These are usually in graduated rates and thus more complicated to calculate than one rate multiplied by earnings. For example, someone might pay 19.5 percent on their first $20,000 earned in a year and 24 percent on their earnings beyond that. If Sione

earns $319 every week, his gross total for the year would be $16,588 ($319 x 52 weeks), so he would pay the lowest tax rate on this. Someone who earned $27,000 might have to pay $20,000 x 0.195 + $7,000 x 0.24 (= $5,580 tax for the year).

Question 2 provides an opportunity to practise the above calculation with new figures. It is worthwhile calculating income, tax, and net income for the range of Sione’s hours (18 to 25). Sione should only count on receiving $198.36 a week because this is the lower end of his earning range. For budgeting ease, he may

consider his income to be $200.

Financial understanding

Students may also like to do some research into employment issues, for example: What is the minimum wage?

What is tax? Why do we pay tax? Why do people pay different rates? Is it fair that people who earn more have to pay more?

Social Sciences Links

Achievement objective:

• Understand how producers and consumers exercise their rights and meet their responsibilities (Social Studies, level 4)

Students could investigate the following: As an employee, who protects your rights and responsibilities?

What are some rights and responsibilities of employers and employees?

Other Cross-curricular Links

English achievement objective:

• Purposes and audiences: Show a developing/increasing understanding of how to shape texts for different purposes and audiences (Speaking, Writing, and Presenting, levels 3–4)

Students could write a job application on behalf of Sione for his café job and include a CV (curriculum vitae; work and experience history).

Answers to Activity

1. a. 22 hours

b. $319. (22 x $14.50)

c. $76.56. ($319 x $0.24)

d. $242.44. ($319 – $76.56)

2. He should budget on an income of $198.36 per week (18 hours, minus tax: $261.00 – $62.64), although some weeks he will get as much as $275.50 (for 25 hours’ work).

Reflective questions

• There might be a fault in the computer program that generated the pay slip or someone may have entered a wrong figure. You might be paid for too many or too few hours; if you have been overpaid, you will owe money later on that you

may have already spent or be paid less at a later date.

• The first step would be to double-check it. If you are sure there is a mistake, you might write down what the correct version should be and why, and then ring or go and see the person responsible for pay at your work.