This is a level 3 number and algebra activity from the Figure It Out series. It relates to Stage 6 of the Number Framework.

A PDF of the student activity is included.

Click on the image to enlarge it. Click again to close. Download PDF (4928 KB)

use mental strategies to add money amounts

use mental strategies to calculate multiplication problems

Number Framework Links

The activities involve interpreting and entering financial information in a table and the addition, subtraction, and multiplication of money amounts.

In Activity One, students could use stage 6 strategies to work out the balance and to calculate how much has been spent in various categories, but the calculations are repetitive and using a calculator or a spreadsheet would help them to generate the information quickly so that they can then concentrate on analysing it. Students working at stage 6 should be able to complete Activity Two using numeracy strategies.

FIO, Level 3, Financial Literacy: Saving for a Holiday, Living Expenses, pages 7-9

Photocopy of bank statement (page 8 in Students' booklet)

A classmate

Activity One

Financial understanding / Mathematics and statistics

In this activity, students learn that financial records tell a story and help people keep track of their spending. By analysing their patterns of spending and income, people can make more informed decisions.

The students are required to collect, organise, and analyse information from the family’s bank statement for the last fortnight. This is important for good decision making. The students need this information to help them find ways for the family to make informed decisions about their spending and develop a plan for saving. It may

be more motivating for the students to complete this activity co-operatively rather than as an individual or paired written exercise. There will be opportunities for you to lead guided group discussion after each question.

You may need to remind the students that there are 26 fortnights (and one or two extra days) in a year. The students may be daunted by all the information in the bank statement and may need to be guided in decoding it.

Spend some time making sure that they understand any unfamiliar vocabulary, such as:

transaction: a commercial deal or process, for example, you might agree to pay a shop $20 in exchange for them giving you a T-shirt, or someone might agree to pay you $5 if you clean their car

withdrawal: money taken out of a bank account

deposit: money put into a bank account

balance: the amount of money left in a bank account after some has been taken out or put in

income: money that is earned or that is coming into the household through overnment grants, such as benefits or Working for Families payments.

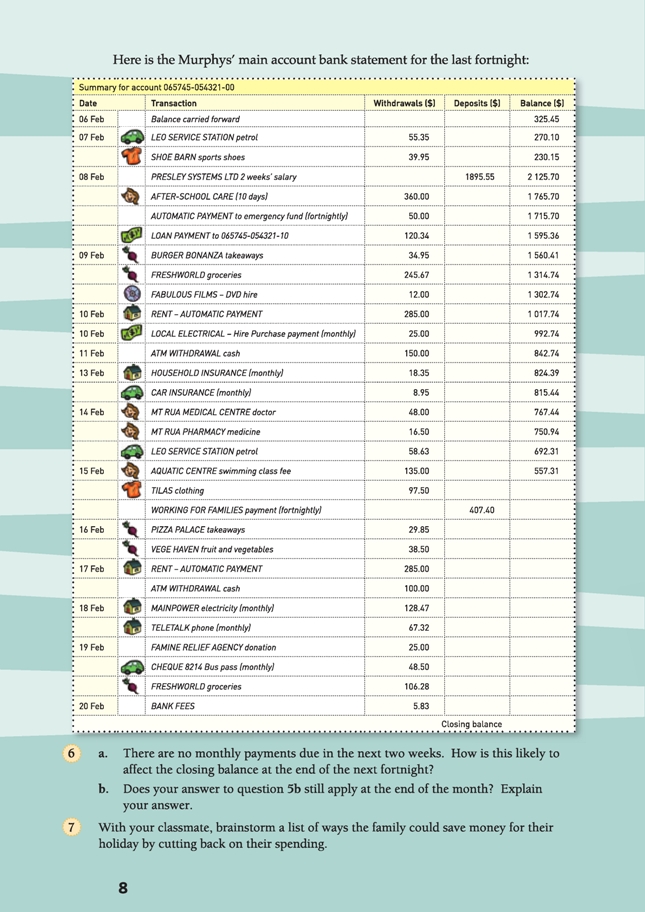

Ask: How much time does this bank statement cover? (14 days, from 6 to 20 February)

How could the little pictures (icons) help you to find information quickly? (You could use them to identify groups of transactions that are similar, for example, all the times the family spent money on the car.)

Which transactions on the bank account statement would be similar to ones on your family’s statement? (You would probably expect to see payments to supermarkets and petrol stations, but you might not necessarily see a payment to an aquatic centre unless you were taking swimming classes.)

Before the students answer question 2, draw a table like the one below on the whiteboard. Ask them to rank the items they think the family would spend the most on and the ones they should spend the least on. Which type of expense do you think will be the greatest? … the least? Why did you choose that one?

Now allocate pairs of students responsibility for one of the different aspects. Each pair is to work out the cost (using the bank statement) and to write it up in the table so that the costs of the various categories can then be compared in discussion. Ask: Were your predictions accurate about which types of expenses would be greatest and least? What surprised you?

Students could discuss question 3 in small groups. It should prompt discussion about how money in one’s wallet or purse seems to “disappear” if no record is kept of what it is spent on.

For question 4, ask What things might the family use the money in the emergency savings account for? (Unexpected bills, such as medical emergencies, travelling to a funeral, replacing or repairing an essential item like a washing machine that breaks down, and so on.)

Questions 5 and 6 are important for helping the students understand what the overall financial picture is for the Murphy family. Ask: Can you find the “Balance carried forward”? How much is it? What does it mean? (It’s on the top of the Balance column and is $325.45. That’s how much money was in the account at the end of the

previous statement on the 6th of February.)

What kind of operation do you need to do in your calculation if there is a deposit into the account? (Addition)

What about for a withdrawal? (Subtraction)

How could we find out whether the Murphy family is spending more than they earn over 2 weeks or whether they saved some money over the fortnight? (Compare the balance carried forward with the closing balance. If the closing balance is bigger, then they have saved that amount.)

Help the students to realise that the Murphys actually spent slightly more than they earned over this fortnight because they started the fortnight with $325.45 in their account and ended it with only $32.46. It may be that Mr Murphy knew they would have no more monthly expenses in the next fortnight and would be able to increase the balance for the start of the next month.

Activity Two

Financial understanding

In this activity, Dad challenges Alana, Caitlyn, and Oscar to contribute money to the holiday fund. By doing this, they are accepting some of the financial responsibility for meeting the costs of the holiday. Dad has also given them an incentive to earn extra money because they can keep any extra funds for their own spending money.

The students will be generating, identifying, and assessing opportunities when they think up new ideas to earn money to fund their portion of a holiday.

Mathematics and statistics

Encourage the students who are working at stage 7 to solve these problems mentally and to share their strategies.

Possible strategies include using:

• place value partitioning: 8 x $45 = (8 x $40) + (8 x $5) = $320 + $40 = $360

• halving and doubling (making proportional adjustments): 12 x $45 = 6 x $90 = $540

• using a known fact and compensating: 8 x 45: if I know that 10 x 45 is 450, then 8 x 45 is 2 lots

of 45 less than that; or $450 – (2 x $45) = $450 – $90 = $360. Book 6: Teaching Multiplication and Division: Revised Edition 2007: Draft, Multiplication Smorgasbord, page 52, shows how to introduce these different strategies.

Related teaching ideas

Get your students to design a financial record-keeping template that they could use for their personal financial records. It could be a ruled-up notebook or a table or spreadsheet they’ve designed on the computer. Encourage the students to take their personal record-keeping design home and use it; make an opportunity a couple of weeks later for them to share their record keeping.

This is a good opportunity to teach the “sum” function on a spreadsheet program to work out the balance column automatically. A formula will take the previous balance, subtract any withdrawals or add any deposits, and give the new balance. The formula for one line might be something like “=SUM(E3–C4+D4)”, instructions that tell the

computer to take the balance in the cell E3, subtract any number that might be in cell C4, and add on any number that might be in cell D4.

Social Sciences Links

Achievement objective:

• Understand how people make decisions about access to and use of resources (Social Studies, level 3)

Students could do a social inquiry into spending at their school and the decisions that the principal, the board of trustees, and so on have to make in running the school. For example, they could look at decisions about access to and use of different resources, such as balls and books.

Answers to Activities

Activity One

1. a. $2,302.95. ($1,895.55 + $407.40)

b. $59,876.70. ($2,302.95 x 26)

2. a. $455.25. ($34.95 + $245.67 + $29.85 + $38.50 + $106.28. Note: Some of the ATM withdrawals may also have been spent on food.)

b. $784.14. ($285.00 + $18.35 + $285.00 + $128.47 + $67.32)

c. $171.43. ($55.35 + $8.95 + $58.63 + $48.50)

d. $12.00. (Note: some of the ATM withdrawals may also have been spent on

entertainment.)

e. $137.45. ($39.95 + $97.50)

f. $145.34. ($120.34 + $25.00)

g. $559.50. ($360 + $48.00 + $16.50 + $135.00)

3. a. $250. ($150 + $100)

b. Answers will vary. It might have been used for paying pocket money, school

expenses, occasional treats, small items from a dairy (for example, milk, daily

c. Answers will vary. Often, if people get extra cash from an ATM (or when they are

paying for something else at a shop), that money seems to get used up quite

quickly, especially if no record of spending is kept. The account balance can go down without them being fully aware of it, and there may not be enough left in the account to pay a bill when it’s due.

d. Answers will vary. You could keep a small notebook and write down each item you spend money on and how much it cost. At the end of a week, balance this against the total of cash you have left and see if it matches!

4. $1.300. ($50 x 26)

5. a. Statement transactions from 15 February

b. The balance is only $32.46, so the Murphys have actually spent all of their income from this fortnight plus some of the balance in the account at the start of the fortnight.

6. a. Answers may vary. For example, if the Murphys follow the same pattern of

spending, the closing balance should be higher because they won’t have paid out

for all the monthly expenses (which add up to $296.59). However, if they know there are no more monthly payments due this month, they might have budgeted to spend that extra money on other items, such as clothes, or on leisure activities.

b. Answers will vary. However, although they may have more money over at the

end of the month than at the end of the first fortnight (unless there is an

emergency), they haven’t enough to spare to save for a holiday from that account if

they continue with the same spending pattern.

7. As well as the ideas on page 9, the list might include having small or home-made birthday and Christmas presents; not having birthday parties; watching films on TV or continuing to hire DVDs instead of going to the movies; looking for cheaper brands at the supermarket and cutting back on expensive treat items; choosing a cheaper sport to do for a season; buying clothing or sports equipment secondhand; saving on power costs by having shorter showers, turning off heated towel rails and

installing energy-saving light bulbs; and reducing or stopping the famine relief agency

donation or similar donations.

Activity Two

1. Oscar: $360. (8 x $45)

Caitlyn: $450. (10 x $45)

Alana: $540. (12 x $45)

2. Answers will vary.

Reflective question

Discussion will vary.

Positive consequences: you can track what is happening to your money and use that information to make informed decisions about your spending and to make saving goals; you might find that you are overspending your income slightly and can

then adjust your spending before you get too far into debt. If you keep good financial records, you can tell at a glance if you have enough money to spare for something special or to pay an automatic payment that is due (as banks can charge you extra

fees if there is not enough in your account to make the payment). You are better prepared if something changes in your life (for example, if you lose your job) and you have to think more carefully about how you spend your money.

Negative consequences: you need to spend time putting the information into whichever system you use regularly to keep the records current and worthwhile. If you don’t keep your records current, then that past time spent on them may be

time wasted. You might get too focused on having a growing credit balance and begrudge spending money on yourself or others (which may be all right as long as you don’t expect others to spend their money on you!).