This is a level 4 number activity from the Figure It Out series. It relates to Stage 7 of the Number Framework.

A PDF of the student activity is included.

Click on the image to enlarge it. Click again to close. Download PDF (1236 KB)

calculate the interest rate on money deposits

Number Framework Links

These activities involve calculation of percentages in the context of money and are appropriate for students who are at stage 8. They should also be accessible for strong advanced multiplicative–early proportional thinkers (stage 7). Students who are at stage 6 will need a considerable amount of scaffolding with the mathematics involved.

Students should preferably have had exposure to percentages before attempting these activities. Students will also benefit here from knowing the conversions between basic fractions and percentages, for example, if they know that 10 percent = 1/10, they will know that calculating 10 percent of 300 is equivalent to finding 1/10 of 300

(that is, 30). (See the table of NDP material on page 4.)

The business section from a newspaper

FIO, Level 3-4, Financial Literacy: Granny’s Gift, Compound Interest, pages 10-11

A spreadsheet (optional)

A classmate

Mathematics and statistics

These activities deal with difficult concepts that most students will not have encountered previously. Before discussing compound interest, students will need to understand how interest is calculated. It is useful to begin with basic amounts such as 10 percent. Explain that banks pay people interest on money in savings accounts.

For example, at 10 percent interest, a balance of $1,000 would earn $100 after 1 year. (Some students will not realise that the interest rate given is based on a per annum [p.a.] rate, that is, per year of investment, even if the term is shorter than 1 year. Also, in reality, interest is usually calculated and compounded on a monthly not

yearly basis, which impacts on the amount of compound interest. Current interest rates are also much lower than 10 percent. However, for the students, working initially on 10 percent per annum is more suited to their numeracy skills.)

Students could practise working out other percentages of $1,000. A ratio table may help with this:

Have the students help you complete the $ amounts in the table. From this table, it is easy to calculate 6 percent of $1,000 (by combining 5 percent and 1 percent, that is, 6 percent of $1,000 is $50 + $10 = $60). Similarly, students can calculate that 12 percent of $1,000 is $120, 8 percent is $80, and, as an extension, that 7.5 percent

is $75. Students at stage 8 and some of those at stage 7 will be able to extrapolate that 6.3 percent of $1,000 is $63.

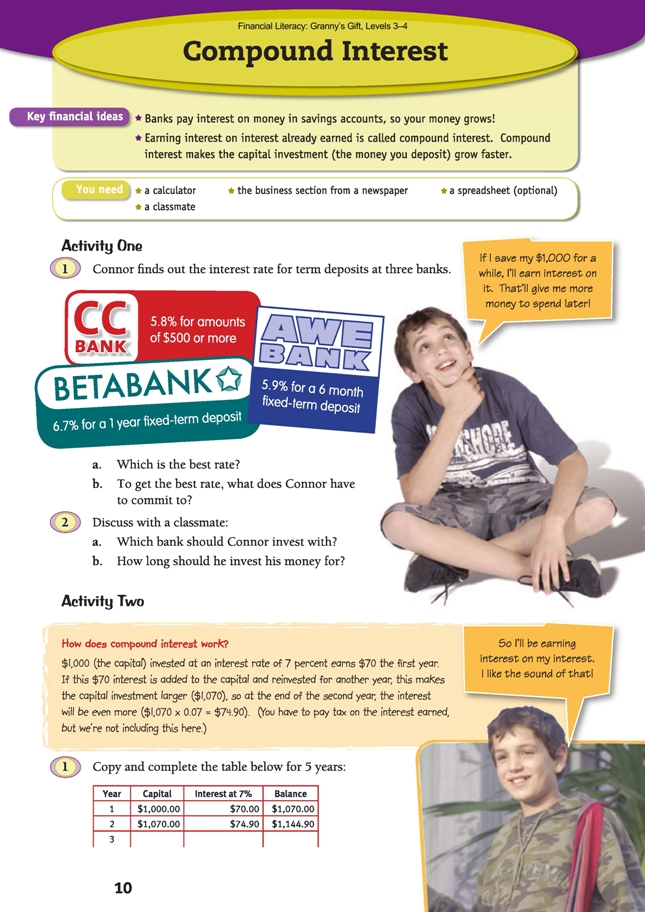

Activity One

Financial understanding

In this activity, Connor investigates how much interest different banks would pay him if he deposited money with them for a certain period of time. He learns that they offer different rates and different terms (time periods).

Clearly, when investing money (called capital) in a bank, a higher interest rate is better than a low interest rate. Note that the length of the term (for example, 6 months or 1 year) does not affect which rate is better, but it may affect the decision as to which bank to choose to invest with (see conditions below).

In question 1b, each investment option contains a condition for investment. AWE Bank requires a 6 month fixed-term deposit, which means the money has to be “locked in” for 6 months; that is, Connor would not be able to withdraw his money for 6 months. Similarly, Betabank requires a 1 year fixed-term deposit. CC Bank

requires an investment of $500 or more. If Connor put his $1,000 into CC Bank, he could withdraw money at any time and still keep the same interest rate, as long as he maintains a balance of $500 or more. Betabank has the best rate but requires Connor to invest for an entire year.

Although question 2 says “Discuss with a classmate”, it is also a good question for you to discuss with a group. See the discussion items for this question in the Answers section.

Mathematics and statistics

Encourage the students to complete question 1a, in the following manner. (Note that 0.1 percent of $1,000 is $1.)

5.9% is 5% + 0.9% → $50 + $9 = $59

6.7% is 5% + 1% + 0.7% → $50 + $10 + $7 = $67

5.8% is $58.

(Note: It is also possible to quickly calculate these interest rates on a calculator. 4.9% of $1,000 can be calculated simply by pushing: 1000 x 4.9 % . This will make the activity more accessible to emergent stage 7 and stage 6 students).

Activity Two

Financial understanding

In this activity, Connor learns that by having money in a savings account at the bank, his capital (original amount of money) grows. He gets paid interest on the previous interest he has earned. This is called compound interest.

As Connor plans and organises which bank and interest rate is going to give him the best return for his money, he is also identifying, assessing, and managing the risks associated with each of his options before he makes a decision.

A good way to begin this activity is a discussion about compound interest. Modelling this physically with money demonstrates the concept well. For example, have a student give “the bank” $1,000 in January. In December that year, the bank pays 10 percent interest of $100 and adds it to the pile. The following December, the bank

adds $110 to the pile because this is 10 percent of $1,100. The following December, $121 is added to the pile. (Note that this is a very simplistic example. In reality, as noted above, the interest is calculated and compounded on a monthly, not yearly, basis. It is also taxed [as noted on the students’ page but left out of the calculations

there for the sake of simplicity] and currently may be more or less than 10 percent per annum.)

Have the students continue modelling the effect of compound interest on the total amount in the bank: before each “December”, have them count the new balance and calculate 10 percent (using a calculator: x 0.1 = if necessary).

After the modelling, the students could complete the following table or set it up on a spreadsheet:

You may need to remind the students that the balance at the end of the year becomes the capital invested at the start of the next year. Students may be surprised at how quickly the balance grows – in this example, the $1,000 invested earns more than $600 in just 5 years.

Mathematics and statistics

Question 1 requires the students to complete a similar table, but this time it is for 7 percent. Although a 10 percent interest rate provides very clean, tidy numbers at first, the numbers are a little more untidy when calculating 7 percent interest. If they have done the 10 percent example, some students will be able to complete this question independently, while others may need to work with you. See below for working:

See the note below on rounding sensibly when using calculators. Doing this as a table means that the students will need to be conscious of the working required, but doing it as a spreadsheet will offer different learning opportunities (see notes below).

For question 2a, to find Connor’s earnings from interest, subtract the balance from the initial investment. The balance at the end of the fifth year is $1,402.55, so he has earned $402.55 ($1,402.55 – $1,000) for his investment. (See the table of NDP material on page 4.)

Using calculators

Although you may wish to have your students use a calculator for this activity, keep in mind that they may lose some overall understanding of the numeracy concepts involved if they do. Knowing how to convert a percentage into a decimal is important prior knowledge. Calculating 7 percent of $1,000 is equivalent to calculating 0.07 x $1,000. The result is added to $1,000, giving $1,070. Repeat for as many years as necessary: $1,070 x 0.07 = $74.90, add this to $1,070 and repeat: $1,144.90 x 0.07 = $80.143, and so on.

At this point, the students need to understand how to round decimal answers sensibly. A final answer of $93.312 should be rounded to $93.31 because it is a money context and the decimal answer should represent dollars and cents. (See the table of NDP material on page 4.)

Extension

Mathematics and statistics

The information below will be useful for the students who are interested in creating a spreadsheet to calculate compound interest. Note that if the figures in the table were calculated using a calculator, there would be some minor differences because the computer spreadsheet does its working on unrounded numbers even though only

two decimal places are shown. The cells are formatted for currency, which involves rounding to two decimal places.

In cell B2 is the original capital investment.

In cell C2, students will need to type a formula such as =B2*0.07. This means “The amount in cell B2 multiplied by 0.07 (or 7%)”.

In cell D2, students will also need a formula such as =SUM(B2,C2). This means “Add cells B2 and C2 together.”

Finally, in cell B3, the students will need to type =D2 because the balance of the previous year becomes the capital for the following year.

Every row will be similar, so rather than retyping using B3, C3, D3, and so on, you can use the Fill Down function by highlighting cell B2 and dragging the bottom right corner down as far as required (you will notice a little + sign as you do this).

The method shown below to calculate the answers in question 3 keeps the capital, interest, and balances separate and identifiable.

For question 3a: Year 1: $1,000 x 0.065 = $65, $1,000 + $65 = $1,065

Year 2: $1,065 x 0.065 = $69.23, $1,065 + $69.23 = $1,134.23

For question 3b: Year 1: $1,000 x 0.05 = $50, $1,000 + 50 = $1,050

Year 2: $1,050 x 0.05 = $52.50, $1,050 + $52.50 = $1,102.50

For question 3c: Year 1: $1,000 x 0.085 = $85, $1,000 + $85 = $1,085

Year 2: $1,085 x 0.085 = $92.23, $1,085 + $92.23 = $1,177.23

Activity Three

Financial understanding

In this activity, the students learn that having money (capital) invested in a term investment account at the bank allows their savings to grow. The younger cousins can’t spend this money now, but in the future they could, or they could choose to put it into a new term investment account and spend it later or invest it in businesses.

Mathematics and statistics

To work out how much each cousin might get when they turn 16 (tax on interest is ignored for the purposes of this activity), the students will first need to calculate the time of investment for each grandchild. Hayden will turn 16 in 6.5 years, Kalala will turn 16 in 4 years, and Tavita will turn 16 in 1.75 years. Students will need to

be comfortable with converting between fractions and decimals to make these calculations.

The spreadsheet shown in these notes for Activity Two can be used to read across how much interest the grandchildren might have made in this time (before tax):

Kalala: $1,310.80 = 4 years

Hayden: $1,500.73 = 6 years, $1,500.73 x 0.07 x 0.5 (for a half year [6 months]) = $52.53, which gives a total of $1,553.26

Tavita: $1,070.00 = 1 year, $1,070.00 x 0.07 x 0.75 (for year [9 months]) = $56.18, which gives a total of $1,126.18.

Investigation

Financial understanding

In this investigation, the students do an investigation of rates and terms similar to the one that Connor did earlier. They need to consider all the variables (including fees charged) to identify the one that offers the “best value” for their investment. The risks and rewards associated with each bank option need to be considered before a financial decision is made.

Newspapers provide interest rates offered by banks – or students could visit banks (in actuality or virtually via the Internet) to find these rates. You may need to reinforce for students that high rates are good for investors, although they do come with higher risks. For example, they may invest for 4 years at a certain rate, but after 2 years, the bank is offering even higher interest rates and they are locked into 2 more years at their contracted interest rate.

Extension

Financial understanding

Students could research and compare savings and investment accounts with cheque accounts. They may like to investigate the “small print” involved, that is, the terms and conditions involved with any deposit (for example, some banks offer a high interest rate if, and only if, no withdrawals are made).

Social Sciences Links

Achievement objective:

• Understand how people make decisions about access to and use of resources (Social Studies, level 3)

Students could research:

– What is interest and why do banks pay interest to people who deposit money with them? How is this paying for access to the people’s money?

– Why do interest rates change?

– What is the Reserve Bank and what does it do?

Answers to Activities

Activity One

1. a. Betabank’s interest rate is the best (6.7% for 1 year, compared with 5.9% and 5.8%).

b. Connor would have to leave his money in Betabank for 1 year to get that rate of

interest.

2. a. Opinions may vary. If Connor wants to save for at least 1 year, he should invest

with Betabank. At CC Bank, he could withdraw his money at any time (getting

the interest for the time invested), but AWE Bank would be better than CC Bank

if he wanted to access his money after 6 months.

b. Answers will vary. It depends on how soon Connor wants to spend some of his money. (He could withdraw up to $500 from CC Bank at any time and still get the 5.8 percent interest rate on the balance.)

Activity Two

1.

2. a. $402.55. (Subtract the initial investment from the balance: $1,402.55 – $1,000)

b. 11 years. (A quick way to calculate this on a calculator or spreadsheet is to take

the 5 year balance [$1,402.55] and keep multiplying by 1.07, counting the years as

you go, until your answer is over $2,000. Note: If you calculated in a tax of 19.5

percent on the interest earned, that would extend the time Connor would need to

double his money to 12 years.)

3. a. $1,134.23. (Year 1: $1,000 x 0.065 = $65, $1,000 + $65 = $1,065; or

year 1: $1,000 x 1.065 = $1,065; year 2: $1,065 x 0.065 = $69.23,

$1,065 + $69.23 = $1,134.23; or year 2: $1,065 x 1.065 = $1,134.23)

b. $1,102.50. (Year 1: $1,000 x 0.05 = $50, $1,000 + $50 = $1,050; or

year 1: $1,000 x 1.05 = $1,050;

year 2: $1,050 x 0.05 = $52.50, $1,050 + $52.50 = $1,102.50; or

year 2: $1,050 x 1.05 = $1,102.50)

c. $1,177.23. (Year 1: $1,000 x 0.085 = $85, $1,000 + $85 = $1,085; or

year 1: $1,000 x 1.085 = $1,085);

year 2: $1,085 x 0.085 = $92.23,

$1,085 + $92.23 = $1,177.23; or year 2: $1,085 x 1.085 = $1,177.23)

Activity Three

a. Approximately $1,311. (Using a spreadsheet, the capital after 4 years is $1,310.80.)

b. Approximately $1,553. (Using a spreadsheet, the capital after 6 years is $1,500.73; $1,500.73 x 0.07 x 0.5 [for a half year] = $52.53; capital after 6.5 years = $1,553.26)

c. Approximately $1,126. (The capital for 1 year is $1,070; $1,070.00 x 0.07 x 0.75 [for year] = $56.18; capital after 1.75 years = $1,126.18)

Investigation

Answers will vary. (Opinions on which term is best value will vary. You might sign up for a 3 year term and then find that interest rates rise after 2 years and you can’t take advantage of that rise. Or, if you are reinvesting at the end of the 3 years, you might

find you have to reinvest at a lower rate, so your choice of 3 years was good.)

Reflective question

Answers may vary. You are paying tax only on the interest you earn on your savings, not tax on the initial amount put into your savings account. The tax you pay is only a proportion of the interest, so your savings balance is always growing. (Note that

interest is paid on income earned – no matter how you earn your income, you pay tax on it. However, there are tax rebates that apply in some cases, for example, if you are a child. Note that children who have an IRD number pay less tax initially than those who don’t have one.)