This is a level 3 number and algebra activity from the Figure It Out series. It relates to Stage 6 of the Number Framework.

A PDF of the student activity is included.

Click on the image to enlarge it. Click again to close. Download PDF (3767 KB)

solve addition and subtraction problems involving money

calculate an average

use multiplication tosolve money problems

Number Framework Links

The mathematics calculations in this activity involve interpreting and using financial information in a table, addition, subtraction, multiplication, and division of money amounts, and finding the average or mean of a group of numbers.

Students need to be capable of stage 6 thinking, but doing all the calculations mentally could make the activity very long and tedious and distract them from understanding what the financial record shows overall. Encourage the students to look at each problem and to decide for themselves whether using a calculator would be more efficient in each case rather than simply reaching for it by default (remind them that sometimes it can take longer to key in the problem than to solve it mentally). Encourage them to use “reverse estimation” when they use a calculator, that is, to look at their calculator answer and decide whether or not it is sensible. Just because a calculator is used does not guarantee a correct answer; pressing the wrong keys or using an incorrect equation can happen at any time!

A calculator or a spreadsheet program

Financial understanding

In this activity, Caitlyn learns that keeping financial records and a close eye on her busking business transactions reduces the risk of not having enough money for her holiday. This type of planning is important for personal and business financial success.

Caitlyn monitors and evaluates her financial records as she works towards her business and personal goals. She will be keen to identify any potential problems and solve them before they become a negative for her enterprise.

This activity requires students to decode the information in the financial records of a busking business and to use that information to predict future earnings and whether or not Caitlyn will meet her savings goal.

To set the scene, ask the students if they or anybody they know has busked and get them to share their experiences and to talk about any costs they had or profit they made. Ask: If you wanted to busk for money, what might you have to pay for in order to be able to perform? What might your costs be? (Equipment, council permit [some councils require this], transport to get there and back, you might have to pay your older brother or sister to supervise you …)

What factors might affect the amount of money you make? (How good you are, how busy it is where you are busking, the weather, how long you do it for, whether people have seen you busking before or you are new to them, and so on.)

Mathematics and statistics

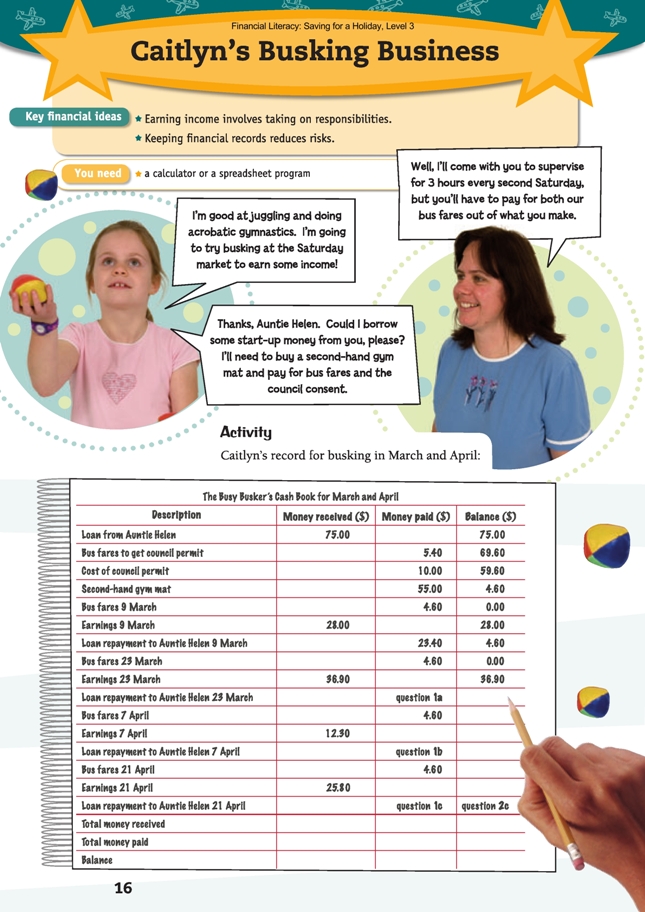

In questions 1 and 2, Caitlyn’s financial records can be daunting for students to decipher, and they will need lots of teacher input to help them to decode them. One idea could be to photocopy them onto OHP or to blow them up to A3 size and reveal them horizontally line by line, talking about what each column header

means and what has happened to the balance in each row. Some students may benefit from acting out the transactions with play money.

Get the students to work out the new balances after each lot of money has been received or paid out and also the answers to questions 1 and 2 when the relevant part of the cash book is reached. They could do this co-operatively in thinking groups of 3–4 and then share their solution and strategy with the whole group.

Ask: What kind of calculation do I need to do if money has been received? (You need to add it on to the balance.)

What kind of calculation do I need to do if money has been paid out? (You need to subtract it from the balance.)

For question 1c, the students need to be aware that the earlier repayment to Auntie Helen of $23.40 (March 9) means that Caitlyn will have reached the $75 pay-back figure from her 21 April earnings, excluding bus fares, and will, in fact, have some over. (This is the beginning of her making a profit.)

Check that the students know definitions for profit and loss to use in question 2d.

Students need to know how to find the average of four numbers to complete question 3. The average, or mean, of a group of numbers is found by dividing the total by the number of numbers in the group. You could draw a strip diagram to represent the varying amounts of earnings. It doesn’t matter if your proportions aren’t exact,

but if your strip is about 50 centimetres long, each dollar would be about half a centimetre, so $27.60 would be about 14 centimetres long.

Say: These are the different amounts of money that Caitlyn earned the four times that she busked in June and July:

You can see that some weeks she received a lot of money and some weeks she didn’t get much. If Caitlyn was to share out the whole amount of money she got so that each week she got the same amount instead of some small amounts and

some big ones, how could she work out how much she’d have each week?

Make another line underneath your strip diagram and divide it up into four even portions. How much money would be in each of these four even parts? What would you have to do to work it out?

Get the students to talk about their strategies in small groups and to then share back with the whole group.

Expect responses such as: “We know that the length of the whole strip would be $103.00 because we added up all the four amounts of money ($28.00 + $36.90 + $12.30 + $25.80 = $103.00). If you share $103.00 evenly into four sections, there would be $25.75 in each part because $103.00 ÷ 4 = $25.75.”

Tell the students that what they have just worked out is the average or mean of those four different amounts of money, a single number that represents all four amounts.

For question 4, you could use the same sort of strip diagrams to help the students visualise that to work out Caitlyn’s hourly rate, they need to take her whole profit and divide it by the number of hours she busks for:

For question 6, the students will need to know that there are about 52 weeks in a year.

Extension

Financial understanding

As extension questions after question 7, ask: Dad pays for Caitlyn’s gymnastics classes. Do you think that Caitlyn should have the money that would have been spent on fees to go towards her savings goal if she drops them for a term?

Does it make a difference to your answer if she was to drop the classes for a whole year? What about if she used the money for something else?

What’s the most Caitlyn could expect to save if she busked once a fortnight for 12 months and saved all her gymnastics fees and all her pocket money? ($437.20 busking + [4 x $150 gym fees] + [52 x $5 pocket money] = $1,297.20)

If she did this, what would the trade-offs be? (Having no spending money during the year, using all her free time every second Saturday morning for a year to busk, and having no gymnastics classes for a year, which may mean she finds it hard to get back into serious gymnastics after such a long break) Do you think that it would be worth it for Caitlyn to save all this money for the holiday? What would you do if you were

Caitlyn? What do you think a good balance would be?

Reflecting back on the Key Financial Ideas would be useful at this point. Ask:

What responsibilities did Caitlyn have to take on?

How do you think keeping financial records reduces risks?

As a follow-up, the students could play the Lemonade Stand Game (do an Internet search on “lemonade stand game” to choose from a variety of them) where they have to buy sugar, lemons, cups, and ice and vary the lemonade recipe and the price depending on the weather forecast to try and make a profit.

Afterwards, discuss the risks that had to be taken in the game and whether or not those risks paid off financially.

Social Sciences Links

Achievement objective:

• Understand how people make decisions about access to and use of resources (Social Studies, level 3)

Students could interview their peers to see what skills and/or talents they have that they could use to set up their own “busking business”. They could discuss why or why not they might do this. The students could also think about this in terms of their own skills and/or talents.

Students could do a social inquiry into the trade-offs involved in an actual “busking business” or use Caitlyn’s as the basis for their investigation.

Other Cross-curricular Links

English achievement objective:

• Purposes and audiences: Show a developing understanding of how to shape texts for different purposes and audiences (Speaking, Writing, and Presenting, level 3)

Students could create a poster to advertise Caitlyn’s busking act or their own fund-raising stall. Different groups could be assigned particular audiences, such as general public, school children, teenagers, parents, and teachers, and asked to use text and visual features on their poster that would appeal to that particular group.

Answers to Activity

1. a. $32.30. ($36.90 earnings on 23 March – $4.60 bus fare)

b. $7.70. ($12.30 earnings on 7 April – $4.60 bus fare)

c. $11.60. (Caitlyn has already paid back $63.40, so she only has to pay $11.60 to

fully repay the $75: $23.40 + $32.30 + $7.70 = $63.40)

2. a. $103.00. (Note that Auntie Helen’s loan is not earnings; $28 + $36.90 + $12.30 + $25.80 = $103.00)

b. $88.80. ($5.40 + $10.00 + $55.00 + [$4.60 x 4]. This includes the cost of the

mat, which she now owns.)

c. $14.20. ($25.80 – $11.60. She will need to use some of this for bus fares the next

time she busks.)

d. A profit ($14.20). (Auntie Helen’s $75 + $103 = $178. Outgoings, including

repaying the $75 from Auntie Helen, come to $163.80. $178 – $163.80 = $14.20)

3. a. Answers will vary. Ideas may include: On the Saturday when she earned only $12.30, it might have been raining and there weren’t many people around to watch her or perhaps there were lots of other buskers at the market that weekend. Perhaps the other weekend when she earned a lot more was a holiday weekend and there were lots of people at the market, or perhaps an unexpected tour bus of generous tourists saw her that day.

b. $25.75. ($103 ÷ 4)

4. a. $42.30. ([2 x $25.75] – [2 x $4.60])

b. $7.05. ($42.30 ÷ 6 or $21.15 ÷ 3)

c. $437.20. ($14.20 from March–April and 6 hours at $7.05 for the other 10 months is $14.20 + [6 x $7.05 x 10] = $437.20)

5. a. $183.40. ($14.20 from March–April and $42.30 for each of the other 4 months is $14.20 + [4 x $42.30] = $14.20 + $169.20 = $183.40)

b. i. Answers will vary. For example, positive consequences: free time for

herself and for Auntie Helen every Saturday for the second 6 months;

not so much effort required.

Negative consequences: loses the opportunity to make approximately

$252 more money.

ii. Positive consequences: saving $150 towards the holiday without

having to work for it.

Negative consequences: misses out on a term’s gymnastic lessons; perhaps

gets behind or misses training for an important competition or exam; perhaps loses flexibility and muscle tone from not doing regular lessons.

6. $130. (52 weeks x $2.50)

7. a. $463.40. ($183.40 + $150 + $130)

b. $13.40. ($463.40 – $450 to family fund)

c. $13.20 is not much for spending money, so Caitlyn will need to think of some more ways to earn money. Suggestions will vary, but she could busk for another month or two, earn money another way, perhaps by doing odd jobs for relatives, or she could save more of her pocket money.

Reflective question

Answers may vary. The main risks are that Caitlyn might not earn enough money to pay Auntie Helen back or to cover the bus fares. A further risk, if she did succeed in paying back the loan, is that she might make no profit from her work. (She spent

nearly 2 months busking before she started to make a profit, so if she had stopped at that point because she was finding it too hard or for any other reason, all that time and work would have had no financial gain.)