Different Decisions

This is a level 3 number activity from the Figure It Out series. It relates to Stage 6 of the Number Framework.

A PDF of the student activity is included.

Click on the image to enlarge it. Click again to close. Download PDF (1348 KB)

use addition and subtraction to solve money problems

Number Framework Links

This activity is appropriate for students working at stage 6. It involves the reading, addition, and subtraction of dollar amounts. Those at stage 5 will need extra teacher scaffolding, while those students working at stages 7 and 8 will be able to complete the task without a calculator. (See the table of NDP material on page 4.)

A classmate

Financial understanding

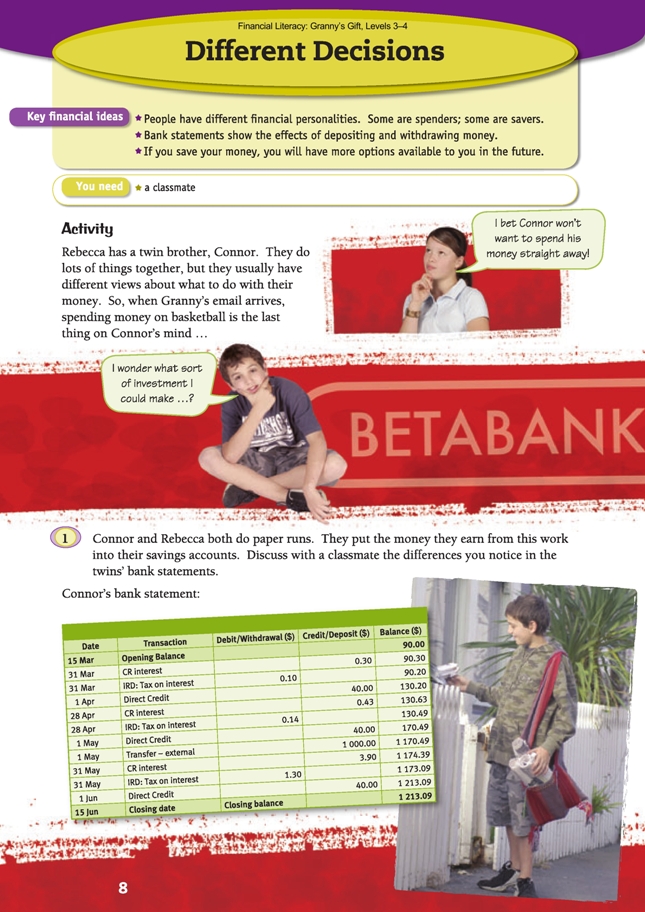

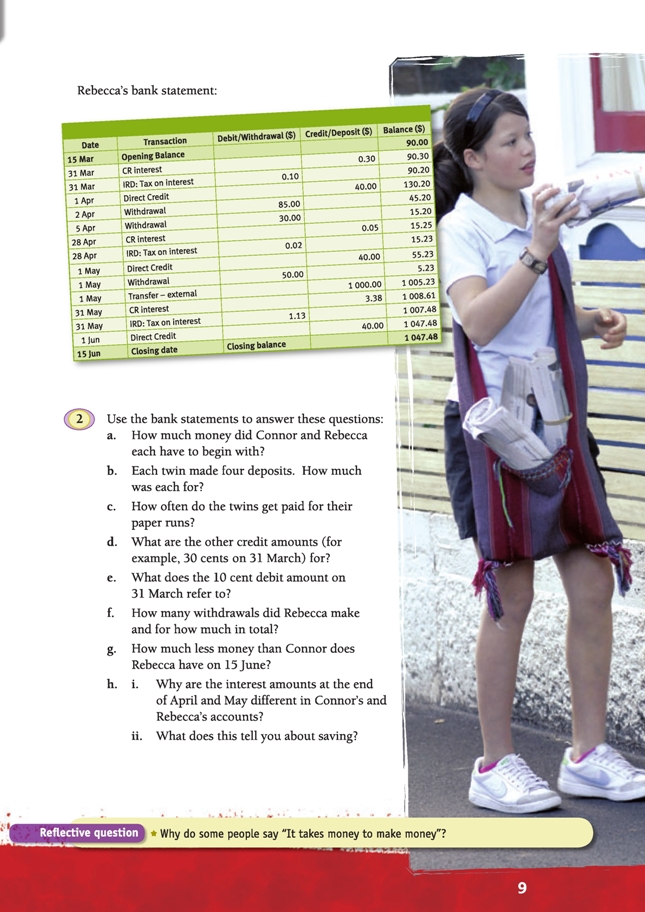

In this activity, students learn that not everyone has the same financial personality or spending and saving habits and that people make different financial decisions. Connor’s and Rebecca’s bank statements reflect this very well.

The students monitor and evaluate when they discuss the bank records of Connor and Rebecca and identify the different saving and spending trends of each child. Ask:

What might have influenced the different spending decisions that Connor and Rebecca made?

Why do people make different decisions? What might they base those decisions on? (Possibly needs versus wants) (See the social sciences achievement objective below.)

Your students will have varied experiences with bank statements, largely depending on whether they have their own bank account or not. A good introduction to this activity is to show students some real bank statements. Discuss the information contained on these statements. You may wish to revise some of the financial terms that appear on them (see above).

For question 1, the students may not initially notice much difference between the bank accounts. One way to encourage their participation in this task is to have them working in pairs or teams and playing “spot the difference”. This should key them into looking at the finer details to notice differences. If they struggle, point them towards the withdrawal columns of each bank statement. This could lead to a discussion on the different “financial personality” of each twin (Connor is a saver, Rebecca is a spender, albeit a sensible one). You may like to ask the students to suggest what Rebecca might have used the money for on each occasion.

Mathematics and statistics

The mathematics in question 2 is straightforward. You may wish to discuss with students the value of using an algorithm to make calculations with large, “ugly” numbers (for example $1,213.09 – $1,047.48, as required in question 2g).

Extension

Financial understanding

The students may be interested in further discussion about the financial personalities of different people. They may also enjoy creating a fictional bank statement for someone who is a “spend-thrift” or a “miser”. They could then look at what needs the person may be sacrificing and what wants they choose to do without.

Students could create their own bank statement (real or imaginary) using a spreadsheet (see the teachers’ notes for pages 4–6 for hints on how to set this up).

Social Sciences Links

Achievement objective:

• Understand how people make decisions about access to and use of resources (Social Studies, level 3)

The students could discuss how interests also impact on our decisions and where those interests come from. The students could research the question “What is the role of banks in our society?” (The students may be under the impression that banks are there simply to provide a service, when in fact, banks are a business and are motivated to make a profit.)

Other Cross-curricular Links

English achievement objective:

• Purposes and audiences: Show a developing/increasing understanding of how to shape texts for different purposes and audiences (Speaking, Writing, and Presenting, levels 3–4) Students could debate the merits of being a spender or a saver.

Answers to Activity

1. Answers will vary. You may notice that Rebecca has a lower balance than Connor on 15 June; Connor makes no withdrawals over the time of this statement; Connor gets more interest on his money than Rebecca does (because his balance is higher); Rebecca withdraws quite large amounts of money (in comparison to her income).

2. a. $90

b. Three deposits for each twin were for $40 (paper run wages) and the other was for $1,000 (Granny’s gift).

c. Once a month

d. Interest on the balance at the end of the month

e. Tax on interest. (Interest that the bank pays you is regarded as income, which is

why you pay tax on it. The tax goes to the Inland Revenue Department [IRD], not to

the bank.)

f. Three withdrawals: $85, $30, and $50. She withdrew $165 altogether.

g. $165.61. ($1,213.09 – $1,047.48)

h. i. Connor’s balance is higher than Rebecca’s, so he earns more interest.

ii. The more you save, the more interest you earn.

Reflective question

Answers will vary. Most of the ways that people use to make money involve spending money first (unless they are doing something physical like housework

or gardening, with all the equipment supplied). If you are making a product to sell, you need startup money to buy the resources and equipment to get started, and you also need to have more money available to replace what you have used in making

those resources (which might be before you have even sold the first completed product). A shop or business that has no money to replace stock that it has sold will not be able to keep trading.