Never too Late

This is a level 3 number and statistics activity from the Figure It Out series. It relates to Stage 6 of the Number Framework.

A PDF of the student activity is included.

Click on the image to enlarge it. Click again to close. Download PDF (1955 KB)

use addition and subtraction to solve money problems

Number Framework Links

These activities involve addition and subtraction of simple decimals in the context of money. They are appropriate for students who are working at stage 6. Students at stage 5 will need extra teacher scaffolding, while students at stages 7 and 8 should be able to complete the tasks without a calculator.

Cash-book sheets (see Copymaster)

Calendar (optional)

FIO, Level 3-4, Financial Literacy: Granny’s Gift, Never too Late, pages 4-6

A classmate

Activity One

Financial understanding

In this activity, Hayden learns about the benefits of keeping accurate financial records of his own spending. Monitoring and evaluating his patterns of spending and flows of income will help him to plan effectively and make more informed decisions about his future spending.

This activity encourages students to use financial records as a way of keeping track of money, regardless of how much or little money they have. You could begin a group/class discussion by asking:

How do you keep track of your spending?

How do other people you know keep track of their spending?

Some students may have seen their parents recording details of cheques in their cheque book or keeping their eftpos and/or credit card receipts to reconcile with a bank statement later. Small businesses may use a cash book and from this create an income and expenditure statement. Most businesses today use a computer spreadsheet, which contains the same information but is set up to do all the calculations automatically. You could use Activity One to make your students familiar with this use of a computer.

Any record of income and expenditure needs to contain information on date, description, money in, money out, balance. Give the students an authentic example of this, using what would be a realistic amount of pocket money and typical expenses for them:

Discuss why it is important to have “description” as a column title (so that spending habits can be analysed).

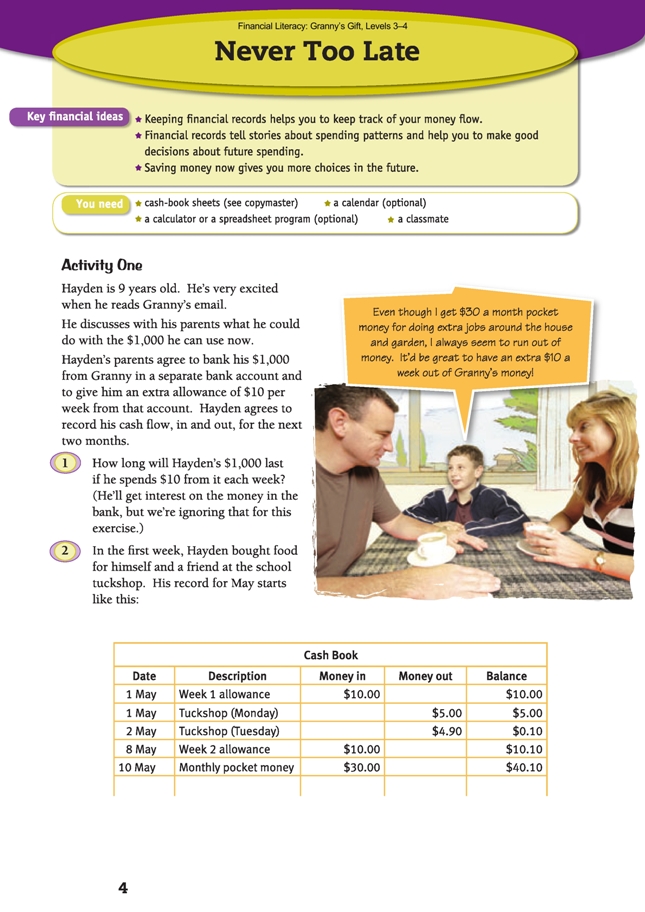

You could follow this with a discussion of Hayden’s cash book (see copymaster for pages 4–6). To familiarise the students with the different parts of a cash book, ask questions such as:

How much has Hayden spent on lunch so far? ($9.90)

When does Hayden have the least amount of money left? (2 May)

How much is this? (10 cents)

Why is there no record for 3 May? (Hayden didn’t spend or earn any money.)

What do you think the entry on 11 May might be? How would you record this? (For example, spent $4 at a bargain shop.)

At this point, many students will be able to complete the activity independently, while others may wish to work in collaborative groups or with you. It’s appropriate here for students to have access to calculators because most adults use calculators when keeping track of their financial records.

You could discuss with students how they think the decisions made by Hayden about the way he uses the $10 a week may change over time.

Extension

Mathematics and statistics

Students could create a spreadsheet of Hayden’s income and expenditure cash book. For example:

Financial understanding

You could also discuss Hayden’s spending habits with the students as a class or group. Encourage them to realise that Hayden nearly always spends all his money, that he sometimes loses money, and that he doesn’t have a lot to show for his spending. This will lead on to Activity Two.

Investigation

Financial understanding

In this investigation, students who have an income keep their own financial records for a 2 week period and then look for patterns and trends in their spending habits. (Students who don’t have a regular income may still get money given to them for birthdays, Christmas, or at other times. They could try to remember how they

spent that money and use that as the basis for looking at patterns.)

This investigation could be used as a homework activity.

Activity Two

Financial understanding

In this activity, Hayden considers setting a savings goal and thinks about saving some of his income now so that he has more choices about what he can buy in the future. For many students and most adults, choices include spending now, saving and spending later, or investing savings into businesses (their own or other people’s).

Hayden demonstrates initiative and drive when he decides to start paying for some of his own clothes and sports equipment from his income. Ask:

Why do you think Hayden’s dad offers to pay $30 towards the shoes?

Why do you think he offers to pay the last $30 instead of the first $30?

Would you rather get the $30 at the beginning or the end?

Would it make any difference to how long you saved for?

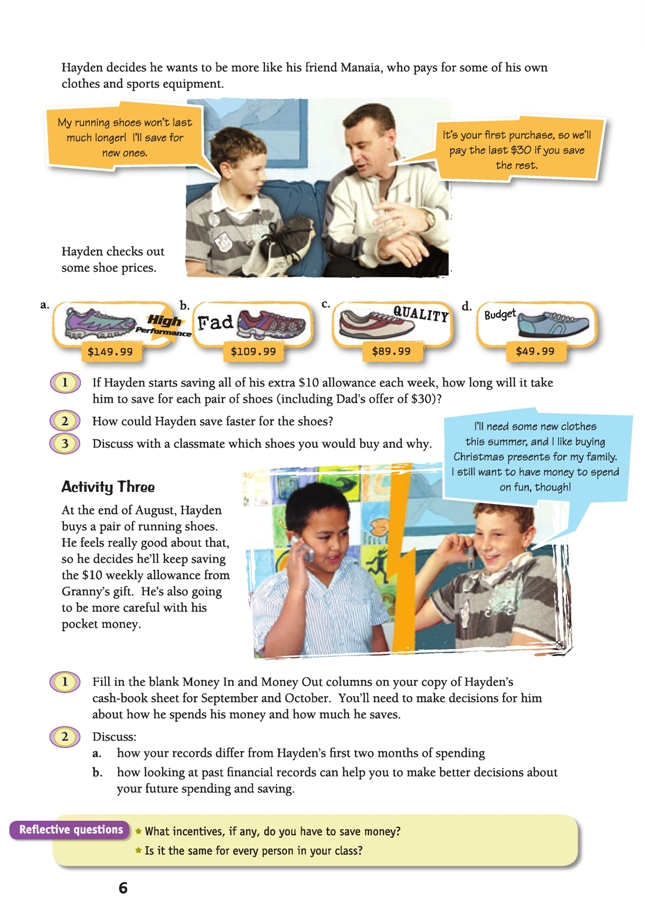

The running shoes in the book are fictional brands. However, this activity will be more meaningful for your students and have more scope if it involves real shoe brands. Use your own and your students’ knowledge of and interest in current fashions or trends to discuss some different sports shoes currently available.

The students could do research on the Internet, in magazines, or in advertising brochures to come up with actual, known examples of:

• the most expensive, top-performance shoe

• a “trendy” shoe brand

• a good quality shoe of a brand that few students know

• a shoe from a well-known “budget” store.

See the cross-curricular link for Social Sciences. Ask What could have influenced the decisions Hayden has made about access to and use of resources?

Discuss with the students the purchasing decision they would make given these choices and why, the various merits of different options, and the trade-off between affordability and desirability. Ask the students to share their own experiences and what they might have learned from them.

What could have influenced the decisions Hayden has made about access to and use of resources?

Mathematics and statistics

Question 1 can be answered by starting with Dad’s $30 and adding in 10s until reaching or passing the shoe price. Encourage the students to use a more sophisticated strategy, for example, rounding $149.99 to $150, subtracting Dad’s $30, and dividing by 10 to get the number of weeks of saving required.

If Hayden also saves his pocket money (question 2), he will have an extra $30 every 4 weeks to put towards his shoes, effectively cutting his savings time by 3 weeks every month. This savings programme makes an interesting graph (see next page) and could provide an extension activity. An analysis of the graph demonstrates

how the savings make a significant jump every time the pocket money is “banked” and grows slowly and steadily with each $10 allowance saved. The students could also mark on the graph the various points at which Hayden has saved enough for each shoe price. They could then look at how the graph would change when Dad’s offer of $30 is added in.

Activity Three

Financial understanding

In this activity, students, acting as Hayden, make more responsible decisions about spending, thereby reducing Hayden’s expenditure and giving him a healthier total at the end of the 2 month period. They generate and use creative ideas and processes to construct a more responsible financial record for Hayden during the months of

September and October.

The discussion for question 2 is a good one to have with the whole group or class. The students could analyse their records from question 1 by grouping their spending into categories (for example, food, toys, entertainment) or simply into two groups: consumables (things used up and now gone) and non-consumables (things that can

be kept). An extension activity might be for students to make a bar graph of the spending habits they imagined for Hayden in question 1. For example, here are graphs based on Hayden’s spending in Activity One.

From these graphs, it can be seen that Hayden initially spent a large proportion of his money on consumables such as entertainment, food, and cheap items at the bargain shop. He lost a significant amount of his money. He spent less than half his money on items that could be kept (CD and new wallet) and, initially, he didn’t save any money for future use. The students could compare these Activity One graphs with the ones they made with question 1 data (if they did make graphs). They could then discuss whether their own financial personalities are similar to Hayden’s in either Activity One or Activity Three, or if different from either, how they are different. The students could then discuss what they might actually decide to do if they had the same amount of money as Hayden.

Mathematics and statistics

For question 1, you may need to remind the students that, although Hayden has decided to save all of his $10 allowance each week from Granny’s gift, he will also get $30 pocket money on 10 September and on 10 October, some or all of which he may decide to spend or save. The students must keep an accurate “running

balance”, that is, they should add the money to or subtract the money from the balance with every transaction.

They can check this at the end by adding up the total amounts in the Money In column (plus the 50 cents for the starting balance) and then adding up the total amounts in the Money Out column. The difference between these two amounts should be the final balance.

Reflective questions

These questions reinforce the role of incentives, including goals, for saving and the fact that people vary in their approach to saving money and their ability to learn from their past spending experiences. Each student could record their financial goals and share these with their class.

Extension

Financial understanding

• The class (or a group of students) could take responsibility for completing a cash book to record income and expenditure related to an upcoming school trip.

• If the class wants to raise funds for a classroom purchase or contribute to the classroom budget, a group of accountants could be assigned the task of keeping a cash book. (This could also be “audited” by another student to check that the calculations are correct.)

Social Sciences Links

Achievement objectives:

• Understand how people make choices about their needs and wants (Social Studies, Level 2)

• Understand how people make decisions about access to and use of resources (Social Studies, level 3)

You could discuss with students what influences their decisions about how they use and access resources. The students could research the spending habits of their school and the decisions made about access to and use of resources in the school setting. They could then complete a budget or a proposal for changes and present it to

the board of trustees.

Other Cross-curricular Links

English achievement objective:

• Purposes and audiences: Show a developing/increasing understanding of how to shape texts for different purposes and audiences (Listening, Reading, and Viewing, levels 3–4)

Students could do further work on the topic of advertising.

Answers to Activities

Activity One

1. 100 weeks (nearly 2 years)

2. a.

b. Answers will vary. For example, “Hayden spends almost all his money each week.

He should put some into a savings account.”

Investigation

Records and spending patterns will vary.

Activity Two

1. a. 12 weeks b. 8 weeks

c. 6 weeks d. 2 weeks

2. He could add some of his pocket money to his savings from his allowance.

3. Choices and reasons will vary. It will depend on what you want to use the shoes for, what kind of shoes you are used to having, how much you value brand names, whether you think the good quality no-brand shoes are better value than the lower end brand-name shoes, and whether you think the lower quality no-brand shoes will last at least half as long as the better quality shoes.

Activity Three

1. Your sheet should show all the weekly allowances and some of the pocket money

saved, and some spending.

2. a. Discussion will vary. The balance will keep increasing overall, despite some spending.

b. Discussion will vary. Past records show when and how money has been spent and

how much saving has been done (or not). You can look at spending and decide, in

hindsight, if that was good spending or not and what to do in future. You can also look at where you could make future savings.

Reflective questions

Answers will vary. People have different incentives based on their personal goals and circumstances, for example, how much money they have available to spend, how much they want a particular item or activity, or their ability to go without something in

order to get something else.