This is a level 3 and 4 number activity from the Figure It Out theme series.

A PDF of the student activity is available.

Click on the image to enlarge it. Click again to close. Download PDF (319 KB)

interpret data and use a calculator to calculate multiplication and division problems

use a calculator to find a percentage

FIO, Levels 3-4, Theme: Moving House, Getting a Loan, page 5

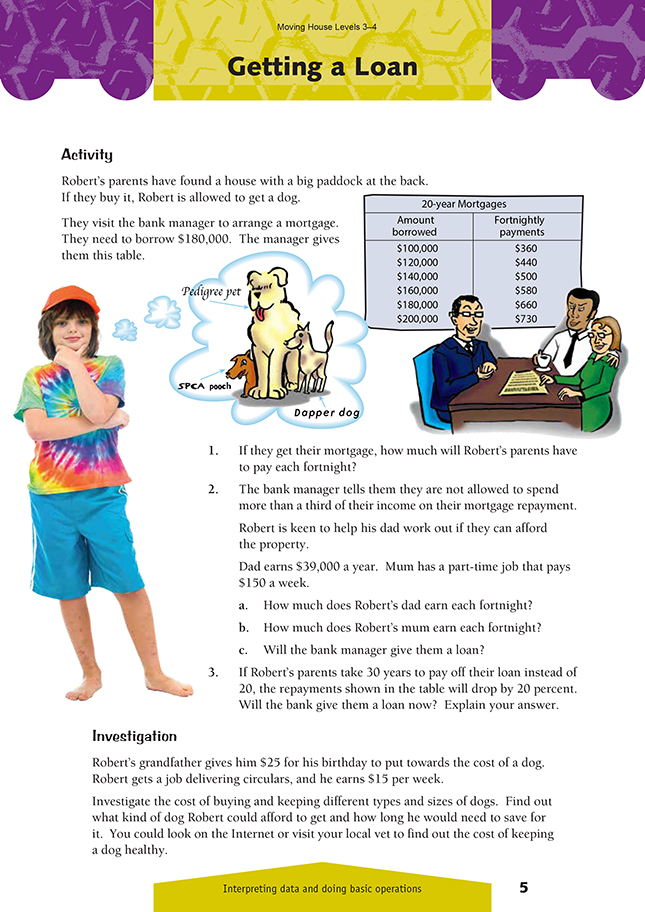

In question 1, the students need only to read the table to see that the fortnightly mortgage repayments on a loan of $180,000 are $660. Question 2 involves straightforward division, multiplication, and addition to determine that the family’s income per fortnight is $1,800. A third of this is $600. The mortgage repayment per fortnight would be $660, exceeding the one-third limit, so the family would not get a loan.

For question 3, discuss with the students different ways of finding 20 percent of an amount (find 10 percent and double it, divide the amount by 5, or find 1/5 of the amount). Discourage them from using a calculator for easily calculated percentages such as these. For practice, they could go on and find 20 percent of all the fortnightly payments. It is important to emphasise that taking 20 percent off leaves 80 percent behind. A common mistake will be to suggest that the new mortgage repayment will be just $132 (20 percent) instead of $660 – $132 = $528.

Investigation

When doing this open investigation, students will need to contact organisations such as the SPCA or a veterinarian or search for information on the Internet about different dogs and the related costs.

Useful websites are: the New Zealand Veterinary Association, www.vets.org.nz and the SPCA New Zealand, https://www.spca.nz/. This could be an excellent project for a pet-loving student.

Further investigation about home loans could focus on the advantages and disadvantages of long term and short-term loans. The students could work out the total amount to be repaid on a $180,000 loan, using the figures from the table. Most will be amazed to learn how much larger this sum is than the original amount. They may also not realise that rates quoted by banks are not normally fixed for long periods, so the final total could be even greater.

Answers to Activity

1. $660

2. a. $1,500

b. $300

c. No, the bank manager will not give them a loan, because $660 is more than a third of their income.

3. Yes, the bank will now give them a loan. The payments would drop to $528 a fortnight, which is less than a third of Robert’s parents’ combined income.

Investigation

Answers will vary.