This is a level 4 number link activity from the Figure It Out series. It relates to Stage 7 of the Number Framework.

A PDF of the student activity is included.

Click on the image to enlarge it. Click again to close. Download PDF (286 KB)

find percentage of a whole number

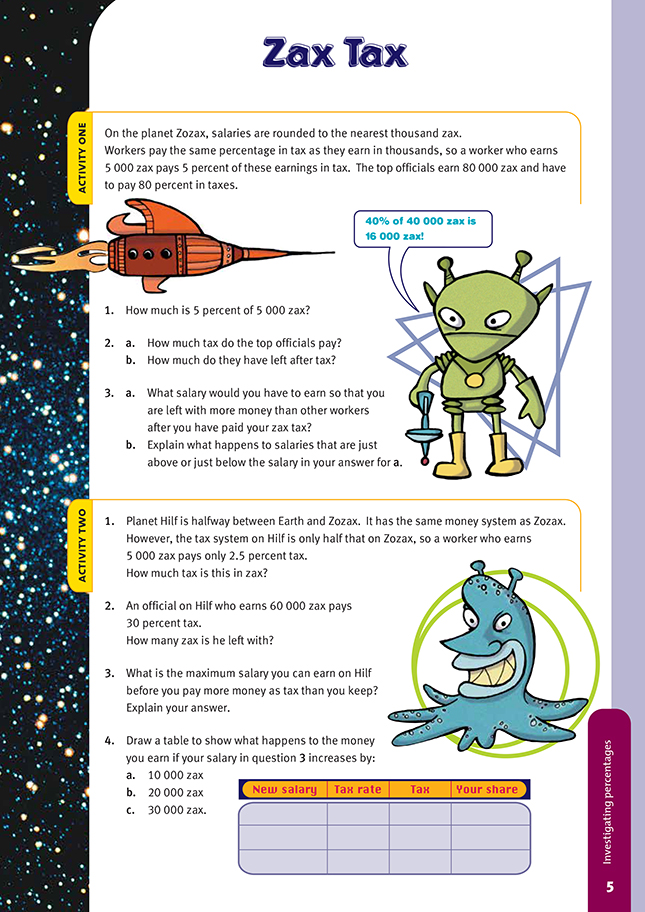

FIO, Link, Number, Book Three, Zax Tax, page 5

For the activities on this page, the students have to make multiple calculations involving percentages and large numbers. They need to clearly organise the information about the zax taxes so that they can see patterns that may help them to answer the questions.

Activity One

You will probably need to have a discussion with the students before they start this activity. They need to understand:

• the concept of taxes, including the difference between salary before and after tax

• how to work out percentages of large numbers

• the need to have an organised way of recording the information they work out.

A table such as the one below would be a good way of setting out their work.

Students who have difficulty seeing any pattern with the taxes and salaries or who struggle to understand what is happening as the salaries get higher may need to organise the salaries into numerical order, for example, $0, $10,000, $20,000, $30,000, $40,000, and so on to $100,000, and work each one out separately.

A table like this helps the students to find the answer to question 3a. They need to realise that the amount of after-tax income doesn’t continue to increase. They also need to realise that, for all before-tax incomes over $50,000, the after-tax income actually decreases. You could ask the more able students to try to estimate

the answer to question 3a using logic and reasoning instead of a table. They should see that for before-tax incomes of over $50,000, people are paying more than 50% (that is, more than half their income) in tax and so are paying more in tax than they are getting in after-tax income. So, people with before-tax incomes of over $50,000 (who are paying more than half their income in tax) are unlikely to be left with more money than other workers after they have paid tax.

If the students are comfortable working out the after-tax income by calculating the amount of tax paid and then subtracting this from the before-tax salary, challenge them to work out the after-tax income in just one calculation. For example, if an official earns $80,000 before tax and pays 80% tax, their after-tax income can

be calculated by finding 20% of $80,000. In order to understand this, the students need to understand that 80% plus 20% is 100%, which is one whole. So if they take 80% away from the whole, they are left with 20%.

You could use this activity to teach or reinforce how to use a calculator to find a percentage. For 80% of $80,000, on most basic calculators you key in 80000 x 80 % . You could also convert the 80% to 0.8 and key in 80000 x 0.8 =

Activity Two

This activity is similar to the first activity, and the same knowledge and organisation of information is needed.

The following questions could be asked at the beginning of the activity to get the students thinking and looking for more efficient ways of working:

“What was the best salary to earn in the previous activity? Why?”

“Is it the figure you thought it would be?”

“What effect did the tax have on this figure?”

“Will the best salary in Activity Two be a high or low amount?”

“Do you need to calculate all the possible salaries?”

“What salaries will you start with and why?”

“How many salaries and taxes do you need to work out to show that your answer is correct?”

“What are some quick ways of working out the percentage?”

Answers to Activity

Activity One

1. 250 zax

2. a. 64 000 zax

b. 16 000 zax

3. a. 50 000 zax

b. Answers may vary. Someone who earned 49 000 zax would pay 24 010 zax in tax, leaving them 24 990 zax. Someone on a salary of 51 000 zax would pay 26 010 zax in tax, also leaving them 24 990 zax. (Take-home pay from 51 000 zax on becomes less and less.)

Activity Two

1. 125 zax

2. 42 000 zax

3. 100 000 zax. On a salary of 100 000 zax, you would pay 50 000 in tax (50%). On a salary of 101 000 zax, you would pay 50.5% in tax, which is more

than half.

4.